Position Sizing: From a practitioner’s perspective

The Pitfalls of Under-Allocating to Winning Stocks and Over-Allocating to Losers

Capital Allocation: How much should I allocate to a particular business?

I explain my thoughts and what I have learned about capital allocation from my guru, Ashish Kila.

Why do we need position size?

There is no single right answer for this. In the initial days, we used to take 10-20% position sizing in a particular business. However, over the years, as I faced challenges, I evolved our thinking and process. If a business does well after taking a substantial position, we are extremely happy, like with Skipper and Mrs Bectors Food. If a business has not performed well and remains stagnant for many years, such as Agro Tech Foods and DCB Bank, we analyse where we went wrong, what mistakes were made, and why our thesis did not work.

Position Sizing: Why we need it

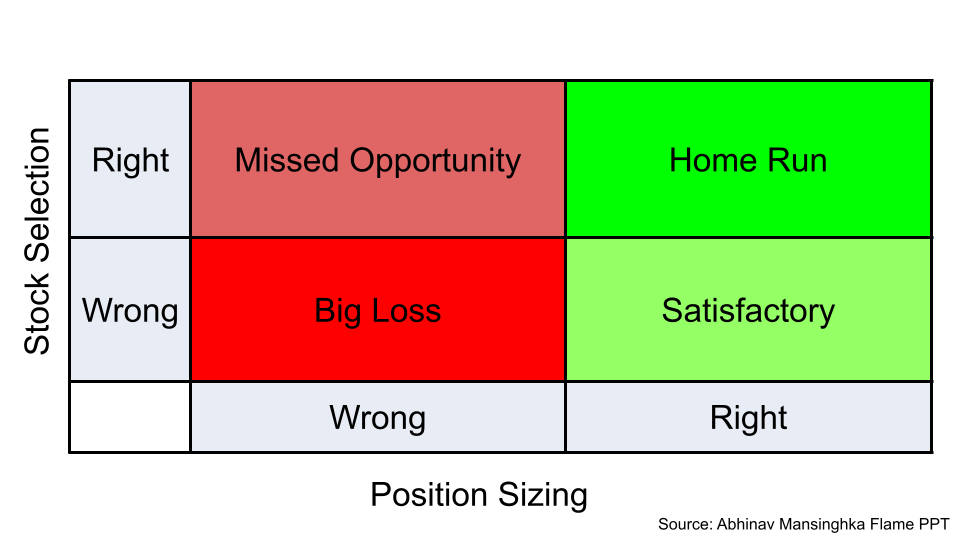

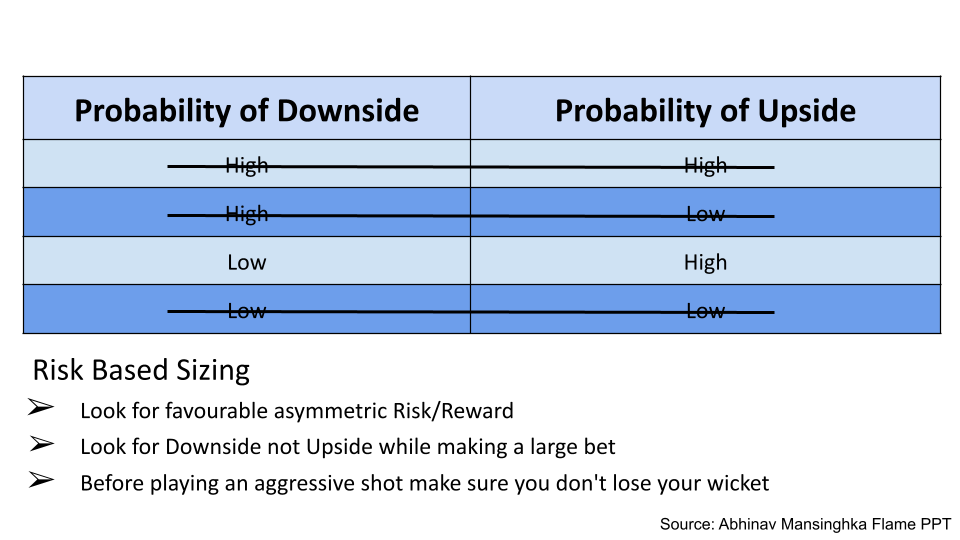

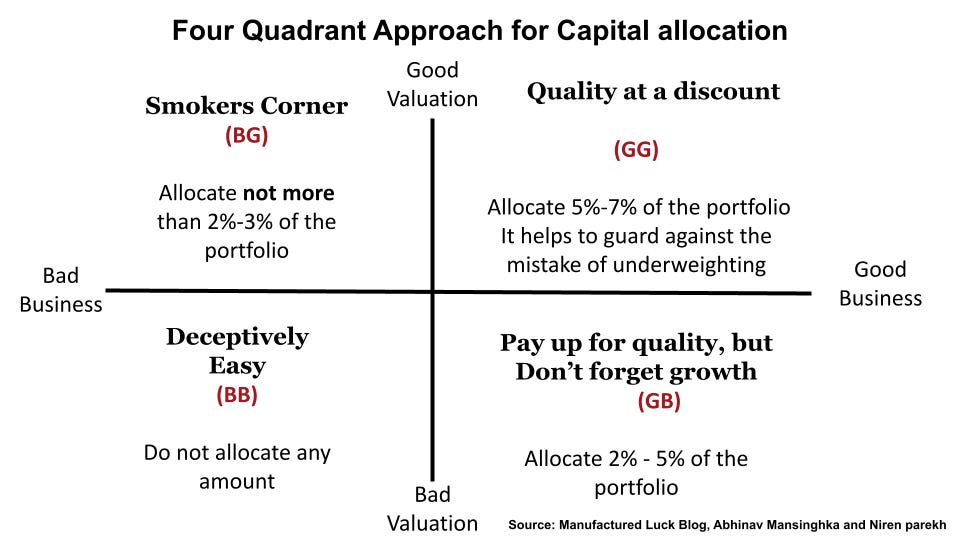

This is a 2x2 matrix taken from Abhinav Mansika's presentation on flame.

Here they explain 4 things:

Selecting the right stocks but allocating less to specific businesses can make us miss opportunities. It's a common and amusing situation for many of us. We often find many multi-baggers, but the problem is that we don't allocate significant money and don't ride the entire stock journey.

In the second case, where the stock selection was incorrect and capital allocation was significant, we faced a loss.

In the case where our stock selection and allocation are both good, we are making some money.

In Case 4, we somehow selected the wrong stock but took a large position, and while some stocks performed extremely well, we ended up with a suboptimal result.

How do we think of position sizing?

Utpal Sheth on Position Sizing

Source: CFA Society India Youtube

As we grow as investors, we see stalwarts achieving returns of 100X and 200X. They didn't identify this high potential in the early days of the particular businesses; instead, they gradually took significant positions in these businesses, increasing their stock positions over the years.

In the early 2000s, investors were torn between TVS and Hero Honda. Initially, Hero Honda took the lead in the race. Just like Rakesh Jhunjhunwala did by allocating 20% of his portfolio to Titan Ltd. in one go, making it a cornerstone of his investments, the choice between these giants showed promise.

Even years later, altering your decision could still pave the way for substantial business growth. Even in 2024, the two-wheeler market continues to grow at 6-7% in volume and value, with a notable trend towards premiumization. It's an intriguing time to observe the future growth of the two-wheeler market.

According to Utpal Seth, allocating 1-3% of our initial investment towards building a position in a particular business is advisable. Sometimes, the market presents opportunities to buy and average down, especially when stocks decline by 30-40% during market crashes. These are the moments when we should consider loading the business into our portfolio.

Prfosers Bakshi on Diversification

Source: CFA Society India Youtube

Prof.Bakshi mentions that diversification not only helps investors reduce risk but also enables them to explore new opportunities. By increasing the number of stocks in the portfolio and reducing allocation to any single business, investors can capitalize on emerging opportunities, rather than restricting themselves to just 10-15 stocks.

Alex Rubalcava's views on portfolio concentration and diversification

How we allocate Capital

Overall Allocation

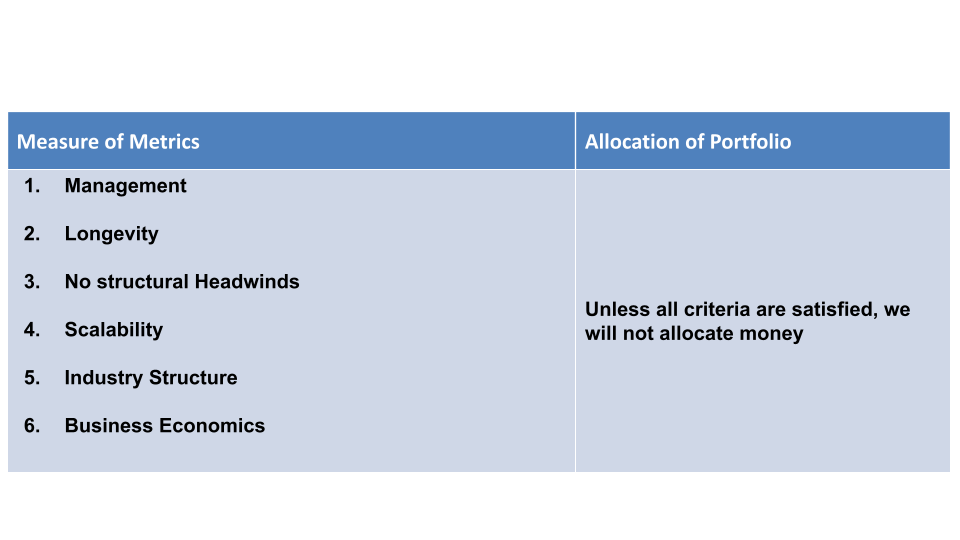

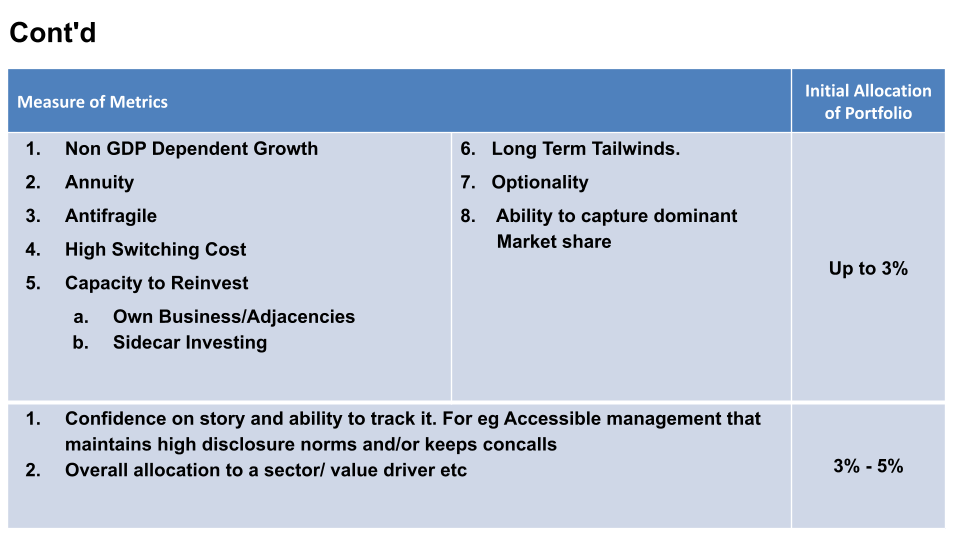

These are some of the criteria and checklists we identify for specific businesses. These criteria must be satisfied to allocate funds. This is particularly relevant for compounding-type businesses that are emerging as leaders, rather than those operating in cyclical industries.

How do we allocate money after all criteria are satisfied

We find which kind of the business this:

Annuity kind business: HDFC Bank, ITC,

Side Car Investing: Info Edge etc….

In one go, we used to buy 3% of a particular business, thereby building our position in that company efficiently.

Where we can closely monitor the company, such as allocating up to 5% of our investments to a single business.

In that case, we bet on how they execute further. We allocate up to 5% specifically to one particular business.

We aim to increase by 5%, reaching up to 10%, strictly on a cost basis. However, the valuation must remain reasonable for this business.

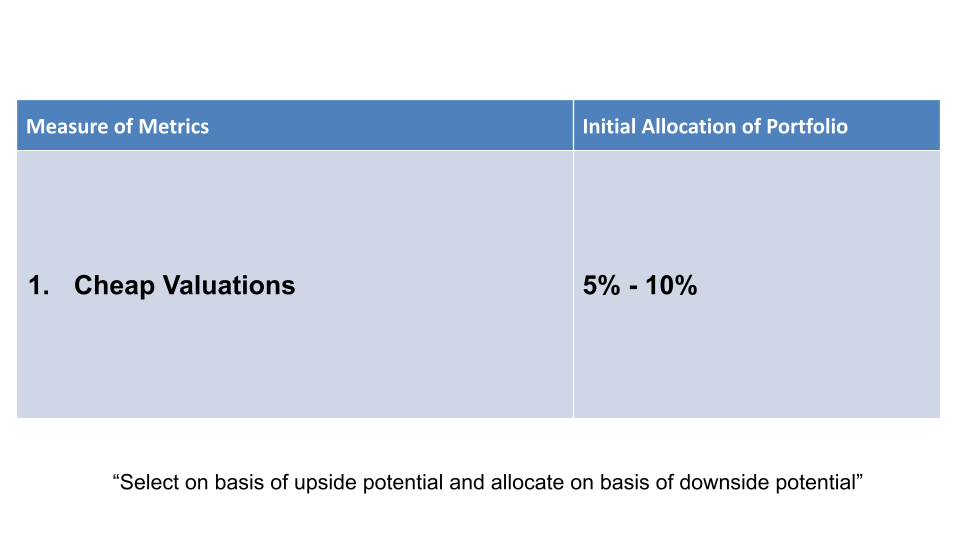

Our strategy essentially revolves around “Choosing businesses based on their upside potential and allocating resources based on their downside potential.”

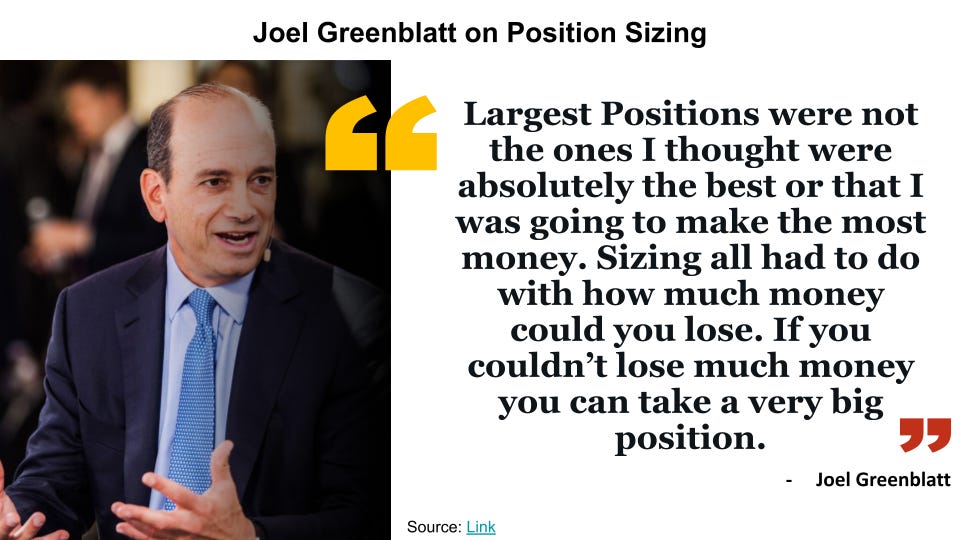

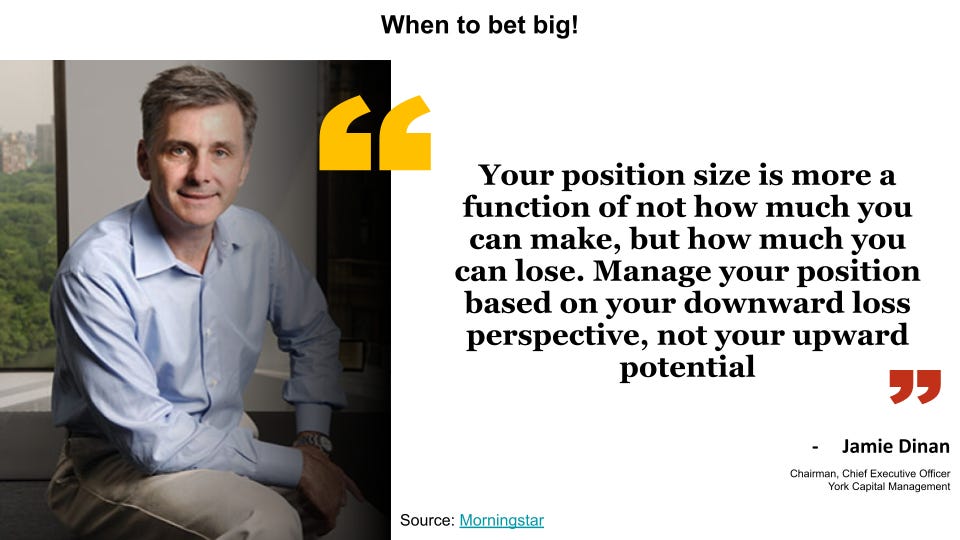

In high-stakes businesses, we prioritize minimizing losses over maximizing gains.

While selecting, consider the opportunities to potentially earn substantial profits, but also assess the allocation to understand potential losses.

When the probability of a downside is very low, the probability of an upside becomes inconsequential. We typically invest larger sums of money under conditions where the risk of loss is minimal.

Sometimes we become enamoured by opportunity, sometimes exhilarated.

Often, higher allocations initially allocate 0.5-3% of funds to a particular business.

Other investor's approaches to position sizing

When to bet big!

Four Quadrant Approach for Capital Allocation

Let me Explain Four Quadrant Approach for Capital allocation:

Quadrant 1: Smokers Corner

When business performance is not very good but the valuation is attractive, we should consider allocating around 2-3% of the portfolio to such opportunities. However, one might ask, why allocate money to a poorly performing business? My reasoning is to invest in a business if the industry itself is experiencing significant positive trends. The business might not be as strong as we would like, but the industry's momentum can compensate for this weakness. For example, in 2022, we bought Titagrah Rail Systems. Although Titagrah Rail Systems was not a great business and the company management had ethical concerns, we invested because the entire industry was benefiting from substantial government capital expenditure on Indian railways.

Quadrant 2: Quality at a Discount

Where business is very good and you get an opportunity to buy business at a very good valuation. In this case, we have to allocate around 5-7% of the portfolio.

Quadrant 3: Deceptively Easy

Where business is very bad and valuation is also too high. In this, we allocating money to this business.

Quadrant 4: Pay up for quality, but Don’t forget growth

Where business is very good but the valuation is too high on this. We allocating money. but the question is, why should we allocate funds to something with such a high valuation? My thesis is that everyone knows this business is great. This business will never be cheap; it will always trade at a high valuation. The reason is simple: everyone knows it's a great business. Great businesses trade at great prices. That's why we should only allocate 2-5% to this.

Great business vs. good Business: Great business and good business differ in their potential for investment. While being a mighty great business may not necessarily equate to a good investment, a good business has the potential to be a great investment.

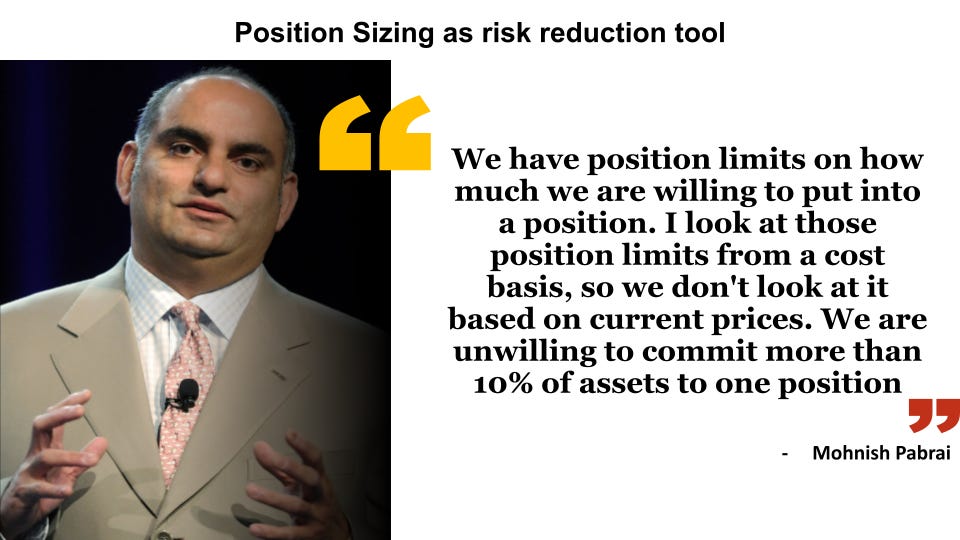

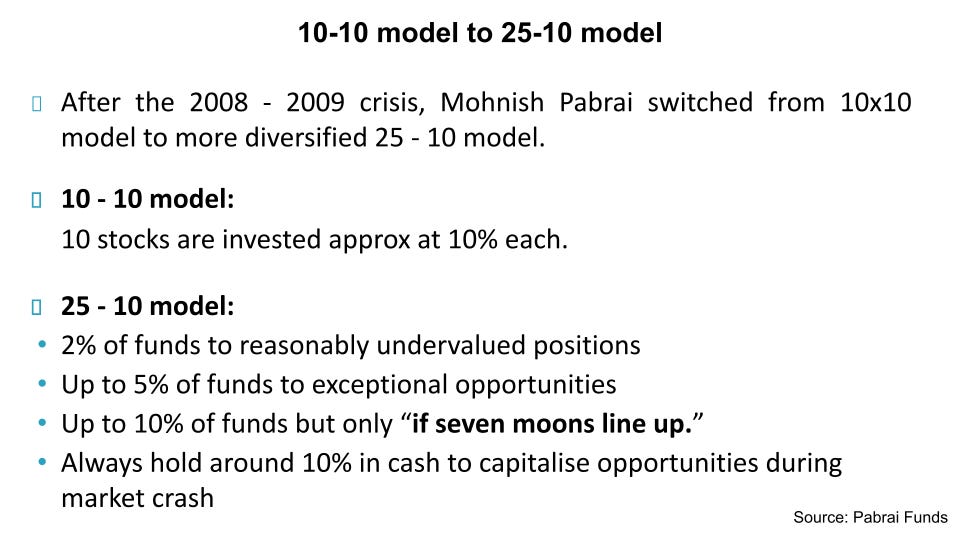

Position Sizing as Risk Reduction Tool

Mohnish Pabrai made significant adjustments to his investment strategy, transitioning from a 10-10 model to a 25-10 model in response to the financial repercussions of the 2008-2009 crisis. This shift reflected his adaptation to the changing economic landscape and aimed to optimise portfolio performance amidst evolving market conditions.

If seven moons align—a rare occurrence—where initially, it seems like a journey of great length, the company continues to thrive, benefiting from its upward trend.

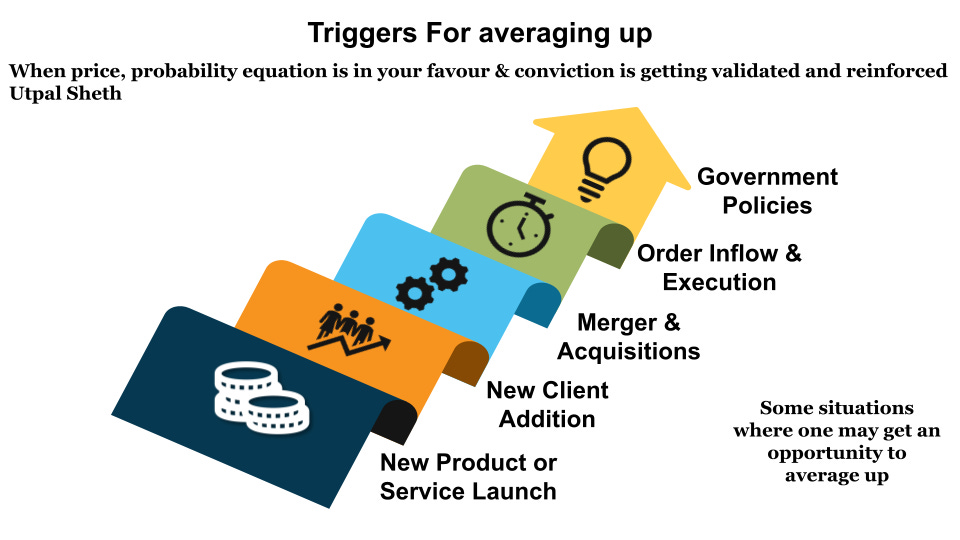

When to average up!

Don’t think of your buying decision as one buying decision at one point in time. Over time as that conviction continues to be validated and reinforced even more, we Should consistently Increase our stock Position. :- Utpal Sheth (CEO, RARE Enterprises)

Triggers for averaging up

Government policy change across various sectors such as defence, electric manufacturing (e.g., the Make in India initiative), pharmaceuticals (e.g., the PLI Scheme), and water management (e.g., the Nal Sa Jal).

Order inflow: As the company secures new orders, investors' assumptions grow stronger that the company will be able to sell its products easily in the future, ensuring a certain cash flow in this uncertain world.

Merger and Acquisitions: When companies merge or acquire peers, they both gain market share, expand their product portfolios, and broaden their geographic reach for their products.

New client addition: When a company acquires new clients, they sell their products and services to them. Adding new clients is highly beneficial from an investor's perspective. However, for some products and services, it can take 2-5 years to gain approval.

Launching new products and services is as crucial as acquiring new clients in the pharmaceutical and chemical industries. Some molecules and products can take 7-12 years to launch for consumers.

Technical as important as fundamental

Technicals: Provide indicators that validate your investment rationale, demonstrating alignment with market sentiment on both returns and losses.

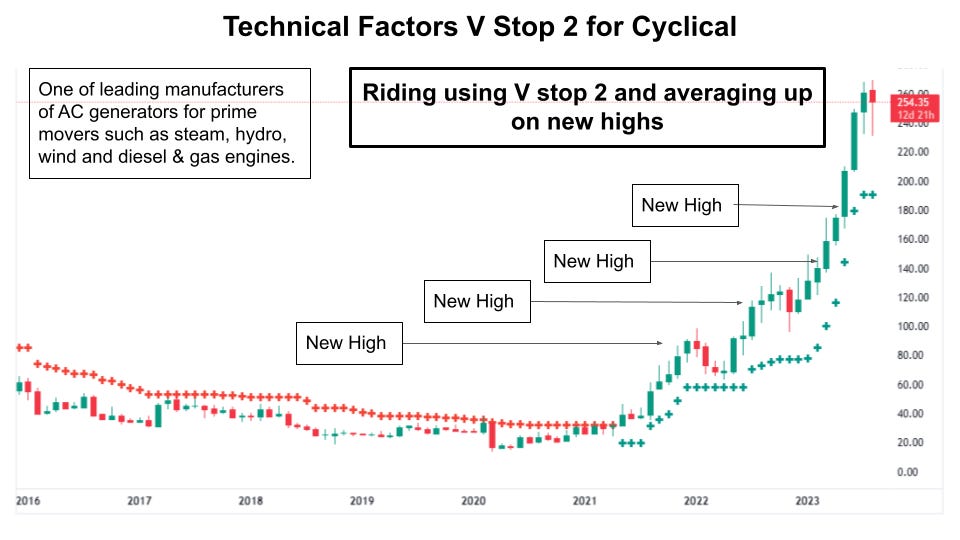

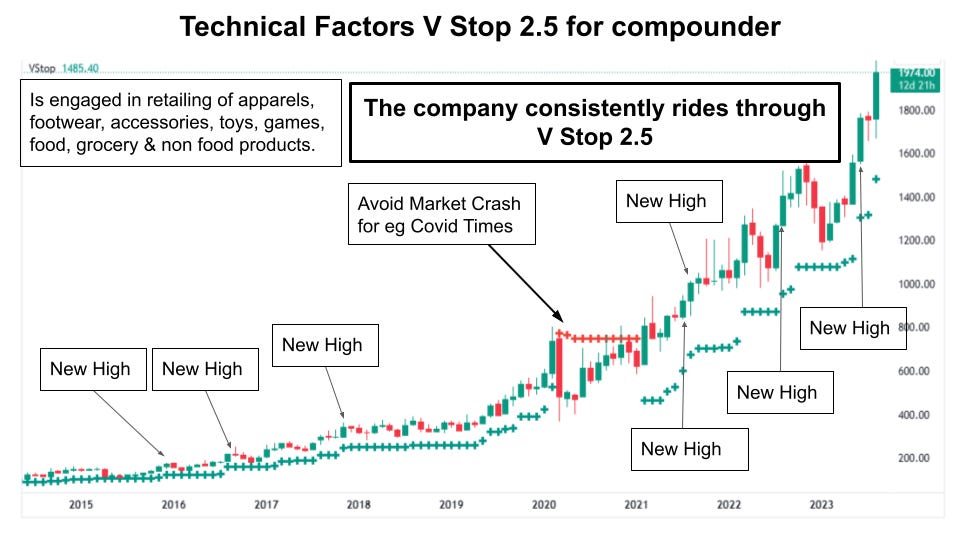

V Stop (Volatility Stop): We average up on every new high with careful consideration. V Stop is one of the indicators we use to manage stock exits, employing V Stop 2 and averaging up on new highs. V Stop 2 is used for cyclical stocks, while V Stop 2.5 is utilised for compounders, based on monthly charts, to optimize our investment allocations and enhance returns.

Average Down

Let the blood on the street, if the market is crashing then we used to average down, if stock is falling in isolation we not averaging down. In this case, we will not fight the market.

In summary

Position sizing as an art

See you in the upcoming letter!

Aditya Shaw